TAX WEBINARS

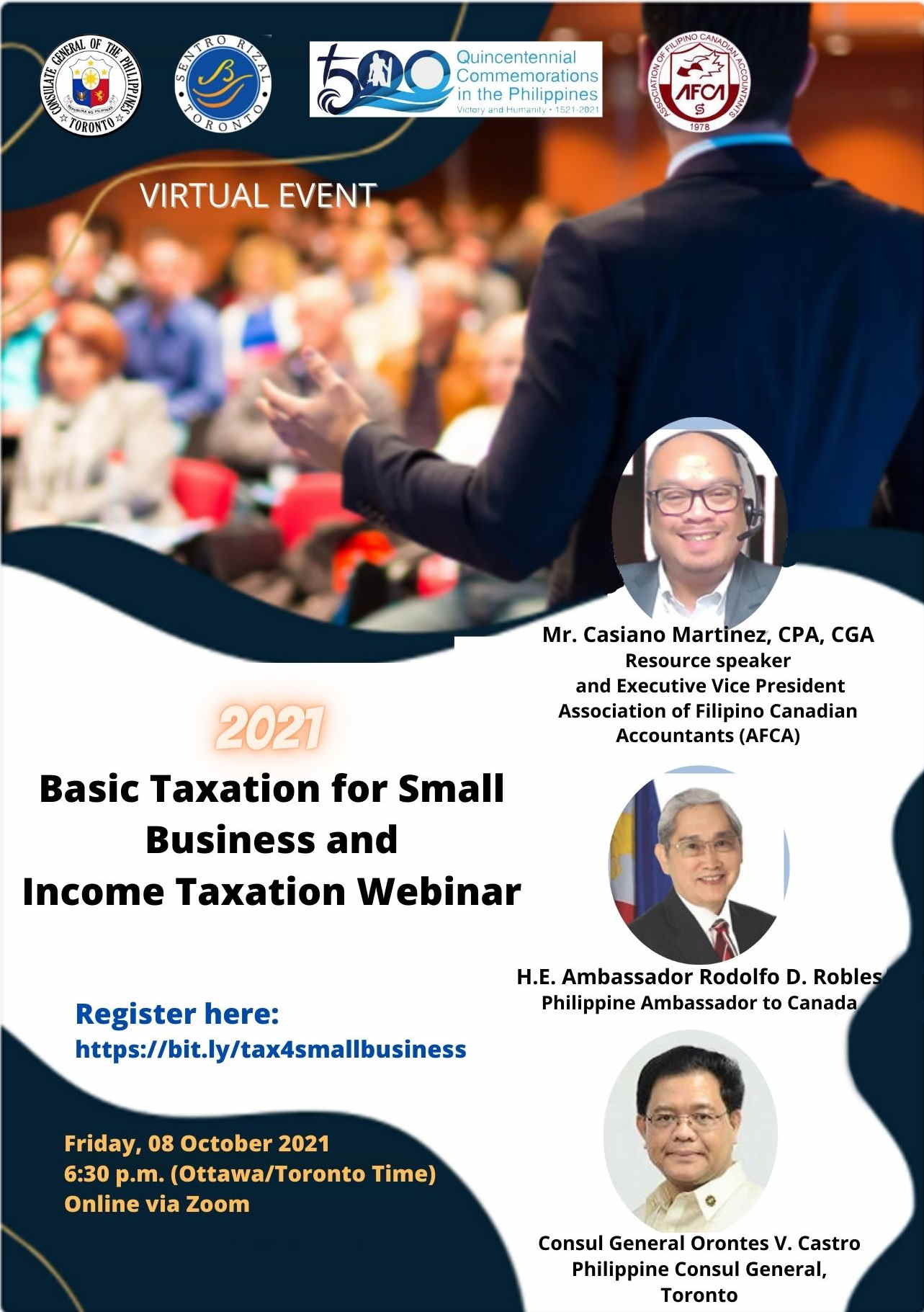

Webinar on "Basic Taxation for Small Businesses and Income Taxation"

The Philippine Consulate General in Toronto would like to inform the Filipino-Canadian community of the free webinar it organized in collaboration with the Association of Filipino Canadian Accountants (AFCA) titled, "Basic Taxation for Small Businesses and Income Taxation" was held on Friday, 08 October 2021 at 6:30 pm (Toronto time).

The Tax Information session will be conducted by AFCA Executive Vice President Mr.Casiano Martinez, CPA, CGA. Topics for discussion are: definition and types of businesses, registration requirements, kinds of business income, accounting of earnings, fiscal period for income tax purposes, business expenses, inventory and cost of goods sold, transferring personal assets to the business, tax filing deadlines, income taxation, among others.

The above webinar is part of the Consulate General's regular tax information campaign and Gender and Development programs, as well as in line with the project of the Philippine Embassy in Ottawa with the other Philippine Foreign Service Posts in Canada on the accreditation of credentials of Filipino Canadian professionals in Canada.

Philippine Consulate General Toronto's Financial Literacy Webinar Titled "Basic Tax Information Training" In Cooperation With The Association of Filipino Canadian Accountants (AFCA)

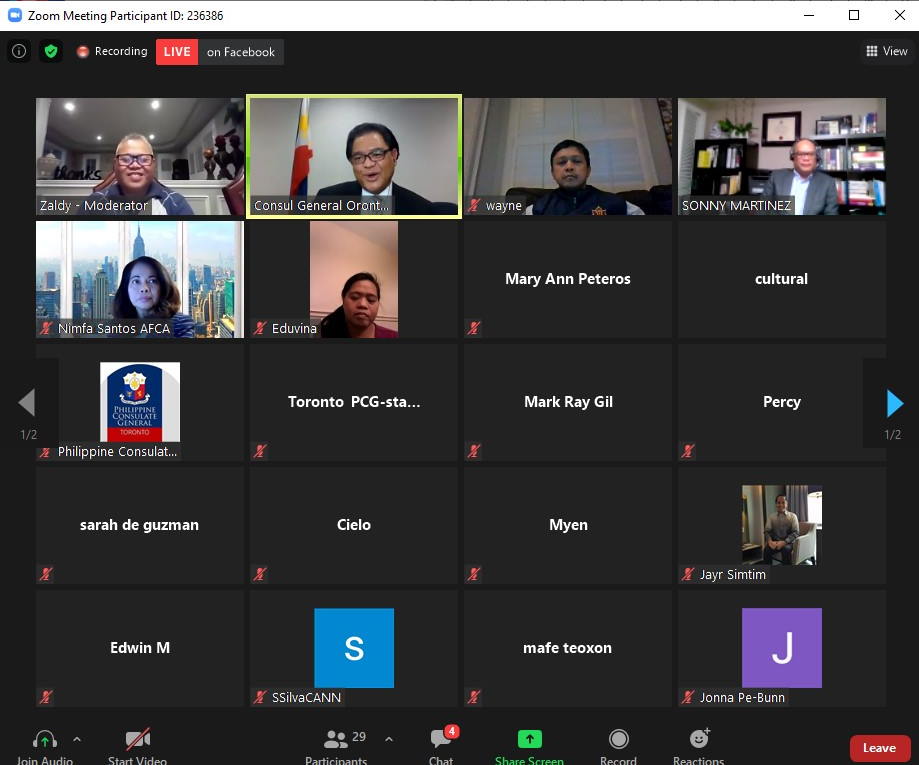

PR 71-2020 Tax Information Training", in partnership with the Association of Filipino Canadian Accountants (AFCA). The webinar on 20 November 2020 was attended by members of the Filipino Canadian community in Post's jurisdiction, as well as the Consulate officers and staff and their dependents.

The webinar was organized as part of the Consulate General's continuing effort of reaching out to the Filipino community and as related to our Gender and Development (GAD) programs for both the community and for the Consulate's personnel.

The webinar was conducted by Mr. Casiano P. Martinez and moderated by Mr. Zaldy M. Perez, both Certified Public Accountants (CPAs) in the Philippines and Canada and officers of AFCA. AFCA's President, Ms. Nimfa Villaroman-Santos was also present and gave her Opening Remarks at the webinar. Consul General Orontes Castro likewise gave his Welcome Remarks to everyone who attended the online tax training.

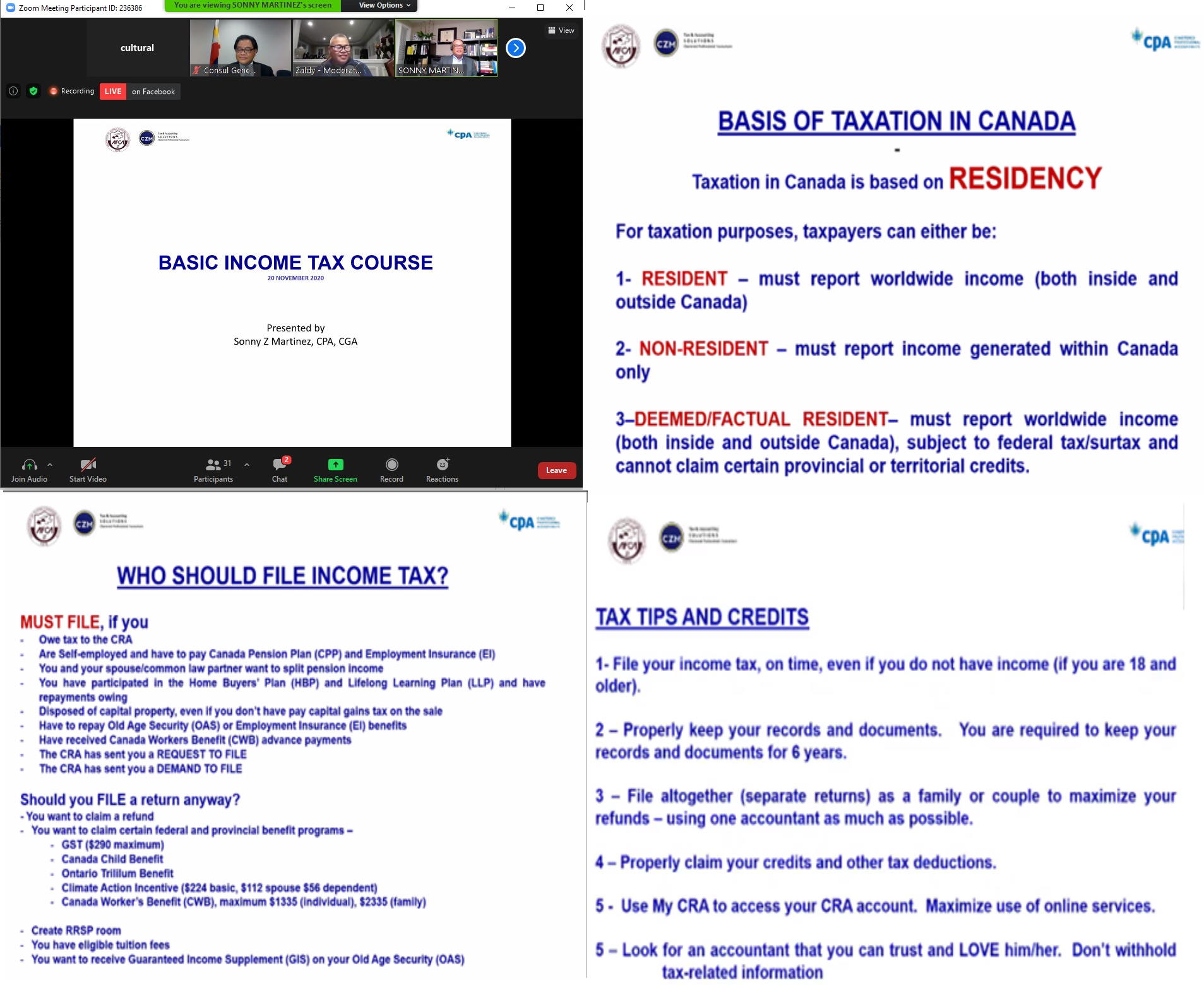

The webinar discussed, among others, the basis of taxation in Canada, the determination of residency status, information on who should file Income Tax, the age required to file, what income are taxable or reportable and those that are not, the tax filing deadline, the income tax rates in both Federal and Provincial, tax tips and credits, basic information needed by one's accountant, refundable and non-refundable tax credits, and other deductions such as medical expenses, expenses of seniors living in retirement homes, charitable donations, and moving expenses. Mr. Martinez also replied to queries raised by the attendees and he kindly gave his contact email address so people could send in their queries.

AFCA is an active partner of the Consulate General in Toronto in providing helpful, practical, and effective projects and services to the Filipino-Canadian community in Toronto and the Greater Toronto Area (GTA).

Before the webinar ended, Consul General Orontes V. Castro thanked AFCA President Ms. Villaroman-Santos for accepting the Consulate Generalís invitation to conduct the Tax webinar. He also thanked Messrs. Martinez and Perez by presenting them Certificates of Appreciation, for the informative presentation and for sharing invaluable advice on the Canadian tax system. The Consul General also expressed his appreciation to the participants who took time off their Friday night to attend the webinar - the officers and members of the Filipino-Canadian community and the personnel of the Philippine Consulate General.

As of 23 November 2020, the webinar garnered 861 views, 17 likes and 9 shares. END